Exiting Planning: The Key to a Successful Exit

Selling a business isn’t always about the price. It is not like selling a house where the most important factor is finding a buyer who is willing to make the highest offer. In fact, in my 25- years of being a business broker, I’d say that in roughly 20% of the deals, the purchase price was not the most important part of the deal. In the end, sellers are focused on achieving a combination of things, and maximizing the purchase price is only one of them.

Selling a business isn’t always about the price. It is not like selling a house where the most important factor is finding a buyer who is willing to make the highest offer. In fact, in my 25- years of being a business broker, I’d say that in roughly 20% of the deals, the purchase price was not the most important part of the deal. In the end, sellers are focused on achieving a combination of things, and maximizing the purchase price is only one of them.

Let’s examine some of the other most common goals and objectives sellers have.

- Maintaining the seller’s legacy. For one client, this means getting the buyer to agree to keep the company’s name (which was also the seller’s name) the same after the acquisition and not roll the company into the buyer’s parent company.

- Protecting Employees. For another client, they were the biggest employer in their small town, and the seller wanted to be sure that the buyer would not close down the plant, fire all the employees, and consolidate operations into their plant about 100 miles away.

- Participating in the Upside. Many clients want to remain involved in some fashion (usually in a passive or silent role) with their business after the sale. This often means accepting a lower price at closing but sharing in the company’s future growth going forward. This can be structured in several different ways, including a minority equity interest, a royalty on sales, or an earnout.

- Timing. Several of my former clients had very specific timing goals. In one case, it was due to the owner’s declining health; in another case, the owner’s son and key employee became disabled. In both cases, the owners wanted to sell as quickly as possible before the business suffered, and its value was diminished.

The best way to ensure that you achieve your goals when selling your business is to develop a comprehensive exit strategy before you start the sales process. This assures that everyone on your team is on the same page and is rowing in the same direction.

The best way to ensure that you achieve your goals when selling your business is to develop a comprehensive exit strategy before you start the sales process. This assures that everyone on your team is on the same page and is rowing in the same direction.

Rich Jackim, the Managing Partner at Jackim Woods & Co, is the author of the best-selling book, “The $10 Trillion Opportunity: Designing Successful Exit Strategies for Middle Market Business Owners”. He has advised over 200 clients to create their exit plans and helped over 100 clients sell their businesses for a combined value of over $500 million. The book’s success led Rich to create the Exit Planning Institute and created the Certified Exit Planning Advisor (CEPA) program. He has trained over 300 lawyers, accountants, financial advisors, consultants, and business brokers to develop exit plans for their clients.

If you are thinking of selling your business in 2021 or beyond, contact Rich Jackim at 224-513-5142 or rjackim@jackimwoods.com for a FREE, confidential, no-obligation discussion about your options.

Read More

The M&A Market Is Back. Buyers Are Targeting These Industries.

M&A deal activity has recovered from its 9-month pandemic-related dip. Based on the overall strength of the stock market, we expect continued strong mergers and acquisitions activity for 2021 as well.

The total dollar value of mergers and acquisitions announced in the U.S. fell to roughly $20 billion in March as the pandemic set in, according to data from Barrons. That was a sharp drop-off—from about $180 billion in January. Yet the recovery has been equally sharp. Deal volumes reached approximately $205 billion in October according to Barron’s data.

Looking forward, Rich Jackim, managing partner at Jackim Woods & Company said, “low-interest rates, optimism about a COVID vaccine, record-breaking fundraising by Special Purpose Acquisition Companies (SPACs), and even a less contentious global trade policy will all contribute to continued strong M&A activity in 2021.”

Interest rates are currently at historic lows, reducing the cost of funding acquisitions. In addition, the good news about several COVID vaccines provides a light at the end of the tunnel and the assurance that buyers need to make a purchase.

And SPACS—special purpose acquisition corporations that raise money through an initial public offering in order to buy other companies—have raised more than $64 billion this year. SPACs raised just $13 billion in all of 2019, suggesting that SPACs will be the new driver of middle-market M&A activity in 2021.

“The M&A wave is regaining momentum and should continue for the next 12-18 months,” Jackim says. He believes the following industries will see an uptick in M&A activity in 2021.

2021 will be a year of recovery as retail and restaurant workers displaced by COVID-related closures seek other careers and gainful employment. As a result, Jackim believes the vocational/technical training and education sector will of interest to buyers and investors. The US has been suffering from a shortage of skilled workers for over a decade, so there are plenty of high paying jobs available for people with the right skills. Enrollment in vocational programs tends to rise as unemployment rises, so we expect 2021 to build on the strong results that the technical education industry saw in 2020, and to attract renewed interest from both financial and strategic buyers and investors.

The energy industry is another industry where we expect to see a lot of M&A activity in 2021. The price of crude oil has dropped to just above $40 a barrel since early summer, nowhere near the $63 a barrel price at the beginning of the year. At the same time, the rise of clean energy and potential regulation are threatening companies that focus on traditional fossil fuels. As the fossil fuel industry shifts toward a lower-growth model, exploration and production companies will be looking to generate returns through acquisitions that would yield economies of scale and other benefits, or diversify their product or service offerings away from fossil fuels.

Education Industry Acquisitions Decrease in 2020 Due to COVID Concerns

Fueled by a multi-billion-dollar deal, the value of mergers and acquisitions in the education sector increased by more than 80% in the first half of 2020, even though the number of transactions dropped to a 30-month low, a new report by Jackim Woods & Co finds.

Overall, the market value of deals in the education sector increased from $4.9 billion in the first half of 2019 to $9 billion during the same period in 2020, according to research by the mergers and acquisitions firm, Jackim Woods & Co.

Jackim Woods & Co is an investment banking firm that provides advice and financial consulting to middle-market companies in the education sector.

Their analysis tracked 1,128 education sector deals between 2018 and June 2020.

Sixty-six percent of that total came from Blackstone’s $6 billion acquisition of student housing company iQ Student Accommodation, which has been described as the largest-ever private real estate deal in the United Kingdom.

Meanwhile, overall dealmaking activity in the education sector slowed significantly due to COVID-19 shutdowns and concerns about the long-term impact it would have on the sector. Jackim Woods & Co tracked 207 mergers and acquisitions in the education sector during the first six months of the year, down from 242 during the same period last year.

That figure also represents the fewest number of total deals for a six-month stretch since at least the beginning of 2018, the period covered in the report by Jackim Woods & Co.

The overall dip in the number of mergers and acquisitions during the first half of 2020 was due to a steep decline in private equity sponsored deals. According to Rich Jackim, Managing Partner at Jackim Woods & Co, only 41 of the 207 deals closed during the first six months of 2020 were financed by private equity firms or other financial investors. That’s the lowest number of deals closed in the 30-month period the report covered and a 50% decrease compared to the same period in 2019.

Only seven deals in the first six months of 2020 were valued at more than $100 million, and at least two were in the K-12 sector. About 33% of the total transactions had values in the range of $4.5 million to $54.6 million.

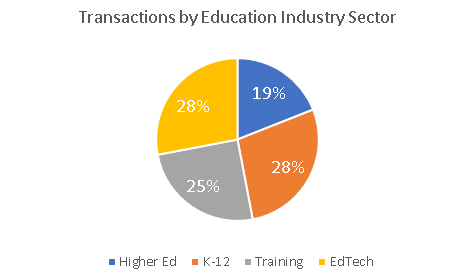

The sector of the education industry that saw the most activity in the first half of 2020 was the professional training services category, which rose from 44 to 60 transactions. That accounted for nearly 30% of all deals during the first six months and marked the most transactions closed for the sector since 2018.

Activity in almost every other segment of the education industry tracked by Jackim Woods & Co — aside from the professional training sector — was down compared to the first half of 2019, according to the report. That includes sectors specific to K-12 institutions and the K-12 EdTech space, which includes companies that provide media and software used in schools.

The most interesting K-12 deals during 2020 include

• China Maple Leaf Education System’s $487 million acquisition of Singapore’s Canadian International School;

• K12 Inc.’s $165 million acquisition of Galvanize, a Denver-based company that offers coding boot camp programs; and

• Chegg’s $96 million acquisition of the math problem-solving app Mathway.

If you own an education-related business, including a Title IV vocational school, K-12 school, or EdTech company, and are thinking about selling, we would be delighted to speak with you and help you explore your options.

and are thinking about selling, we would be delighted to speak with you and help you explore your options.

Contact Rich Jackim, Managing Partner of Jackim Woods & Co at 224-513-5142 or at rjackim@jackimwoods.com.

Read More

Negotiating the Price Gap Between Buyers and Sellers

Sellers generally desire all-cash transactions; however, oftentimes partial seller financing is necessary in typical middle market company transactions. Furthermore, sellers who demand all-cash deals typically receive a lower purchase price than they would have if the deal were structured differently.

Although buyers may be able to pay all-cash at closing, they often want to structure a deal where the seller has left some portion of the price on the table, either in the form of a note or an earnout. Deferring some of the owner’s remuneration from the transaction will provide leverage in the event that the owner has misrepresented the business. An earnout is a mechanism to provide payment based on future performance. Acquirers like to suggest that, if the business is as it is represented, there should be no problem with this type of payout. The owner’s retort is that he or she knows the business is sound under his or her management but does not know whether the buyer will be as successful in operating the business.

Moreover, the owner has taken the business risk while owning the business; why would he or she continue to be at risk with someone else at the helm? Nevertheless, there are circumstances in which an earnout can be quite useful in recognizing full value and consummating a transaction. For example, suppose that a company had spent three years and vast sums developing a new product and had just launched the product at the time of a sale. A certain value could be arrived at for the current business, and an earnout could be structured to compensate the owner for the effort and expense of developing the new product if and when the sales of the new product materialize. Under this scenario, everyone wins.

The terms of the deal are extremely important to both parties involved in the transaction. Many times the buyers and sellers, and their advisors, are in agreement with all the terms of the transaction, except for the price. Although the variance on price may seem to be a “deal killer,” the price gap can often be resolved so that both parties can move forward to complete the transaction.

Listed below are some suggestions on how to bridge the price gap:

- If the real estate was originally included in the deal, the seller may choose to rent the premise to the acquirer rather than sell it outright. This will decrease the price of the transaction by the value of the real estate. The buyer might also choose to pay higher rent in order to decrease the “goodwill” portion of the sale. The seller may choose to retain the title to certain machinery and equipment and lease it back to the buyer.

- The purchaser can acquire less than 100% of the company initially and have the option to buy the remaining interest in the future. For example, a buyer could purchase 70% of the seller’s stock with an option to acquire an additional 10% a year for three years based on a predetermined formula. The seller will enjoy 30% of the profits plus a multiple of the earnings at the end of the period. The buyer will be able to complete the transaction in a two-step process, making the purchase easier to accomplish. The seller may also have a “put” which will force the buyer to purchase the remaining 30% at some future date.

- A subsidiary can be created for the fastest growing portion of the business being acquired. The buyer and seller can then share 50/50 in the part of the business that was “spun-off” until the original transaction is paid off.

- A royalty can be structured based on revenue, gross margins, EBIT, or EBITDA. This is usually easier to structure than an earnout.

- Certain assets, such as automobiles or non-business-related real estate, can be carved out of the sale to reduce the actual purchase price.

Although the above suggestions will not solve all of the pricing gap problems, they may lead the participants in the necessary direction to resolve them. The ability to structure successful transactions that satisfy both buyer and seller requires an immense amount of time, skill, experience, and most of all – imagination.

The post Negotiating the Price Gap Between Buyers and Sellers appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

SBA Introduces Partial Loan Payment Program for Business Buyers

As part of the $2.2 trillion CARES Act, the SBA is now offering to make six months of payments on SBA loans, including both principal and interest. This partial payment program is part of the SBA’s flagship 7a loan program and applies to both existing SBA loans as well as new SBA loans that are closed before September 27th, 2020. SBA lenders, the public stock market, and businesses of all sizes recognize that a significant disruption has occurred in their business activities. The SBA is paying six months of payments for current SBA borrowers to relieve stress on business owners and attempting to “keep our small business economy going.”

It is important to note that this is not a payment deferment plan, instead, the SBA will actually make payments of principal and interest for buyers.

If you are a potential buyer, it’s important to remember the following:

- This is a temporary economic incident. There is no fundamental economic weakness.

- There is lots of liquidity in the finance and banking sectors, this is not a repeat of the 2008 financial crisis.

- Interest rates are at an all-time low and are unlikely to go up soon. As of mid-April, the interest rate for a 10-year SBA 7a business acquisition loan was 6%.

- Businesses in essential industries, like food processing, distribution, manufacturing, online retail, third party logistics, delivery, warehousing, IT, and healthcare may actually see an improvement in overall financial results.

- Many small businesses will benefit from pent up demand.

- Businesses that were overpriced at the end of 2019 will be repriced to reflect current market conditions.

- Many small businesses will see a decrease in wage costs as the unemployment rate increase and workers look for new employment.

If you are interested in taking advantage of this program, keep in mind that deals must be closed by September 27, 2020 to qualify. So, working backward, you may want to keep the following timeline in mind:

- Sign letter of intent – May 15th

- Complete Buyer’s Due Diligence – June 1st

- Secure Lender’s Financing Proposal – June 15th

- Lender Submits Loan to Underwriting – June 30th

- Lender Underwriting Completed – July 31th

- Purchase Agreement Completed – August 28th

- Target Closing Date – September 1st

- Fall-back Closing Date – September 15th

- Drop Dead Closing Date – September 27th

Since the CARES Act became law, we have had several conversations with bankers and non-bank lenders. They believe this is a once in a lifetime opportunity for entrepreneurs who are thinking about buying a business. They have shared with us some of the insights they are getting from their credit committees and executives that are being taken into account when reviewing loan applications and making a credit decision before issuing a loan term sheet:

- Lenders realize now is not the time for inexperienced entrepreneurs to be buying a business. Lenders are looking to back buyers with strong operating track records, a solid personal balance sheet, and a clear vision about how they will be able to rebuild sales and pay down debt in a post-Coronavirus economy.

- Even though the SBA will be making the payments for the first six months on newly originated loans, lenders can not take that into the credit decision. To qualify for the program, the cash flow of the business needs to be able to support the loan payment without taking into account the SBA payments.

- Lenders are willing and able to take into account the impact the Coronavirus has had on the business when valuing a business, but buyers must have a clear and realistic plan to get cash flow back to pre-pandemic levels.

- Certain businesses, especially those that provide “essential services” are especially attractive candidates for this program right now, because they were not as severely impacted by the pandemic as other businesses.

For additional information about this unique SBA loan payment program, visit the BizBuySell Financing Resource Center or contact Richard Jackim at 224-513-5142 or at rjackim@jackimwoods.com.

Read More

The Evolving Impact of COVID-19 on Business Sales and M&A Activity

The rapidly evolving impact of the COVID-19 virus is being felt everywhere—in the healthcare system, employment, politics, and the economy. This is certainly a time of uncertainty in our lives and businesses. The closest thing I can compare it to is the tremendous uncertainty everyone felt in October 2008 as the financial crisis was unfolding.

Then, like now, business owners are seeing the values of their business plummet. Smaller businesses are naturally more vulnerable in an economic downturn, but everyone is affected in one way or another. Strategic and financial buyers, sellers, business owners, and M&A advisors are all paying attention right now and trying to understand how this will impact them, and how they can mitigate the negative consequences.

Reflecting on the financial crisis of 2008-2009, however, helped me identify a few things that are likely as we deal with the impact of COVID-19 on the M&A market and business sales.

Like in 2008 and 2009, M&A activity will most likely contract significantly in the near future as the volatility in the stock market will likely put the M&A market on hold. For deals in the early stages, there will be a lot of anxiety on the part of sellers and a lot of caution on the part of buyers. As a result, we expect that many buyers and sellers will press the pause button to wait and see how the situation unfolds over the next few months.

But there are a lot of indicators that when the COVID-19 scare is behind us, the M&A market will rebound with gusto. Right now, strategic buyers and private equity groups are flush with capital. Not only are PE firms ‘open for business’ but many of them are accelerating efforts to close in-process deals, and even to scale future investing activities.

“I’m bullish on the outlook for M&A activity in the medium and long term once the financial markets adjust to the ‘new normal’. There is an unprecedented amount of capital that needs to be deployed, interest rates are at record lows, and the federal government’s stimulus package should make borrowing even easier. At the same time, the record high valuations that we’ve seen over the last year or two are likely to decrease, which will make financing acquisitions less risky and fuel a strong increase in M&A activity.”

Richard Jackim, Managing Partner, Jackim Woods & Co.

If you are a business owner thinking about selling, what does all this mean to you? First and foremost, it’s important to remember that while the next few months may be painful, the fundamental value of your business is likely still intact. There is no doubt that if you were waiting for the market to peak before you sell you missed the window. But that doesn’t mean your business is unsaleable or that it has no value. The value is still there because buyers buy companies for the future cash flow that business will generate. That means buyers take a long-term perspective. If your business is fundamentally sound, it is very likely that its value will rebound once the economy returns to the new normal.

Many of the business owners I’ve spoken to in the last few weeks believe that the current market conditions will scare away buyers. It is true that undercapitalized buyers will sit on the sidelines and wait for the dust to settle, but stronger financial and strategic buyers will recognize the short-term nature of the crisis and see this as a good opportunity to buy a good business at a lower multiple of EBITDA than last year.

If you’re thinking of selling your business it’s important to work with someone who understands the dynamics and changing motivations of sellers and buyers to advise you during these uncertain times. Below are our recommendations for business owners to take over the next 2-3 months if you are thinking about selling in the next few years.

- Focus on Exit Planning (talk with us about our formal process that can use this time to help you and your business get prepared for sale)

- Get an evaluation of your business (so you understand how much your business is worth)

- Understand what you can do to improve the value of your business and make it more attractive to potential buyers

- Talk to your financial advisor to understand how much you need to retire

- Work with an M&A advisor or business broker to begin putting together a data room and formal marketing materials so you can hit the ground running when the market recovers.

Our team is comprised of experienced investment bankers and M&A professionals who literally wrote the book on exit planning. We helped over three dozen companies between 2008 and 2010 help get ready for sale and then sold them for top dollar when the market recovered. We will provide you with a value-focused, hands-on approach to help you and your business develop a strategic exit plan that allows you to exit your business on your terms and for its highest possible value.

If you are interested in selling in the next three years and would like to talk to a licensed business broker and M&A professional about how this crisis affects your options, please feel free to contact Rich Jackim for a FREE, confidential conversation at rjackim@jackimwood.com or at (224) 513-5142.

Read More

It’s Time to Exit. Are you Ready?

Thinking about whether or not you are ready to exit is an important question. It’s something that every business owner will have to address at some point. Importantly, you don’t want to wait until the 11th hour to prepare to sell your business. There are far too many pieces in this particular puzzle to wait until the last minute. You’ll want to begin the process sooner by asking yourself some key questions.

Determining Value

First, you’ll need to determine the actual value of your business. It is a harsh truth, but what you think your business is worth and what the market feels that it is worth may be two very different things.

This point serves to underscore the importance of working with a business broker or M&A advisor early in the process. An experienced broker knows how to go about determining a price that will generate interest and seem fair. Remember that at the end of the day, it will be the marketplace that determines the value of your business, but working with a seasoned professional is an excellent way to match your offering price with what the market will ultimately bear.

Going Within

Secondly, you’ll want to consider whether or not you truly want to sell. It is not uncommon for business owners to begin the process of selling their business only to realize a few hard facts. Wanting to sell and the time being right to sell are often two different things.

Upon placing your business on the market for sale, you may learn that you’re not emotionally or financially ready. If this happens to you, consider it a learning experience that will serve you well down the line.

Get Your Ducks in a Row

If you have done a financial assessment, a little soul searching and have begun working with a business broker or M&A advisor to determine that now is a good time to sell your business, then there are several steps you’ll need to take. You can be sure that any serious prospective buyer will want a good deal of information regarding your company.

At the top of the list of items potential buyers will want to see are three years of profit and loss statements as well as federal income tax returns for the business. Other important documents ranging from lease and lease related documents, lists of loans against the business and a copy of a franchise agreement, when applicable, are all additional documents that you will need to provide. You should also have a list of fixtures and equipment, copies of equipment leases, lists of fixtures and equipment, and an approximate amount of inventory on hand. A failure to not have this information organized and ready to present at a moment’s notice could be a costly mistake.

Working with professionals, such as accountants, lawyers, and brokers, is a savvy move. Owning and operating a business can be a complex process, and the same holds true for selling a business. Investing the time to seek out experienced and professional advice is the first step in selling your business.

Determining the Right Time to Sell

Determining when it’s finally the right time to sell can be a tricky proposition. If you are thinking about selling your business, one of the best steps you can take is to contact a business broker. A good business broker will have years, or even decades, of proven experience under his or her belt. He or she will be able to guide you through the process of determining what you need to do in order to get your business ready to sell.

One major reason you should contact a business broker long before you think you might want to sell is that you never know when the right time to sell may arise. Market forces may change, unexpected events like a large competitor entering your area, or a range of other factors could all lead you to the conclusion that now, and not later, is the time to sell.

In a recent The Tokenist article, “When is the Best Time to Sell a Business?”, author Tim Fries covers a variety of factors in determining when is the best time to sell. At the top of Fries’ list is growth. If your company can demonstrate a consistent history of growth, that is a good thing. Or as Fries phrases it, “What never varies, however, is the fact that growth is a key component, buyers will look for.” Growth will be the shield by which you justify your price when you place your business on the market.

If your business is experiencing significant growth then you have a very strong indicator that now could be the time to sell. Fries points to a quote from Cerius Executives’, CEO, Pamela Wasley who states, “When your business has grown substantially, it might be time to consider selling it. Running a business is risky, and the bigger you get, the bigger the risks you have to face.” Again, growth is at the heart of determining whether or not you should sell.

Knowing the “lay of the land” is certainly a smart move. For example, have there been a variety of businesses similar to your own that have sold or were acquired recently? If the answer is “yes,” then that is another good indicator that there is substantial interest in your type of business.

Reviewing similar businesses to your own that have sold recently can help you determine how much buyers are paying for comparable businesses. This can help you spot potential trends. In short, you should be aware of market factors. As Fries points out, everything from relatively low taxes and low interest rates to strength in the overall economy and an upward trend of sales prices can impact the optimal times for a sale.

Now, as in this exact moment, might not be the right time for you to sell. Getting your business ready to sell takes time and preparation. Fries points out that smart sellers “look for a good time, not the perfect time” to sell a business. Working with a business broker is a great way to determine if now is the right time to sell your business and what steps you have to take in order to be prepared for when the time is right.

Should You Sell Your Family Business?

When the complicating variable of family is added to the equation of selling a business, the situation can get rather messy. Family usually complicates everything and businesses are, of course, no exception. Ken McCracken’s recent article “Family business: to sell or not to sell?” 6 questions to help you make the right decision,” seeks to decode the complexities so often associated with family businesses.

Consider the Market

The foundation of determining whether or not now is the right time to sell must begin with market forces. Determining how much your business is worth is a key variable in any decision to sell.

The best way to determine the worth of your business is to have an outside party, such as a business broker, evaluate your business. What you believe your business to be worth and what the market dictates could be very different. You may discover that your business does not have the value that you hoped for. If this is the situation, then selling simply may not be an option.

What is Next for You?

Tied to knowing your market value is understanding what you will do next after you sell your business. For example, do you have a family member who can run the business without you? What will you and any family members who work for the business do after the sale goes through? You may discover that the sale could be very disruptive for you personally. All too often, people fail to recognize the emotional and mental stress that comes along with selling a business. Many owners begin the selling process only to discover that they are not emotionally ready to do so. While everyone wants to be unemotional in making their business decisions, this is not always the case.

Due Diligence

You will also need to deal with the issue of due diligence. Working with a business broker is an excellent way to handle the due diligence process. Business brokers usually vet prospective buyers ahead of time, which can save you a great deal of aggravation and wasted time.

McCracken believes business owners should investigate how the prospective buyer handled previous acquisitions. Specifically, McCracken believes that business owners should look to how well the prospective buyer honored previous commitments, as doing so is an indicator of how trustworthy a buyer may be.

Planning for Negotiations

Finally, McCraken believes it is essential to know who will oversee negotiations. It is key to note that many deals that could have otherwise been successful, fall apart due to poor negotiations. A business broker can be invaluable in negotiations. After all, who wouldn’t want someone with dozens, or even hundreds, of successful transactions advising them?

Selling a family business can be emotionally charged and can cause significant life changes for not just you, but for members of your family as well. Often, family businesses were built up over a lifetime or even over generations, which can make the decision to sell quite emotionally charged.

Overview of Mergers and Acquisitions in the Education Sector 2019

2019-2020 saw a steady increase in M&A activity in the education sector. Strategic buyers and investors are scrambling to adapt to changes in learning modalities while private equity groups and financial buyers have shown renewed interest in the sector because of changes in the regulatory environment and the increased reliance on scaleable technology. In many instances, there is an ongoing shift from live, in-person instruction to an emphasis on online or blended instruction.

The K-12 education market remains active, as new technologies and services continue to improve student performance and teacher efficiency, improving overall educational outcomes. Companies that offer adaptive learning solutions and assessment products continue to have a meaningful impact. Advancements in online education, digital classrooms, specialized curriculum, and peer-to-peer sharing platforms are transforming the ways that students and teachers collaborate both inside and outside the classroom.

With the emergence of the COVID-19 pandemic and subsequent closure of schools worldwide, remote learning became more important than ever. Laptops and tablets have accelerated the pace at which students are utilizing digital tools and content, allowing the introduction of new entrants into the sector and compelling existing education providers to evaluate new technologies and teaching models. However, there is an uneven level of accessibility and preparedness for remote education in K-12 throughout the U.S.

The Higher-Ed sector has seen rapid advances in EdTech with online tutoring, instruction, proctoring, testing, grading, and assessment gaining traction and expanding rapidly. This includes rapid advances in automated online grading in subjects such as chemistry, math, and other quantitative disciplines. Recent developments in AI-based, automatic grading of essays and papers also garnered a lot of attention from investors.

Current M&A Market Landscape

Jackim Woods & Co tracked over 900 education industry merger and acquisition (M&A) transactions beginning in 2018 through the end of 2019. Note that this covers all segments, including traditional brick-and-mortar higher ed and childcare services companies, as well as EdTech deals, which accounted for nearly half of the total transaction volume. K-12 EdTech/Media and Professional Training Services were tied as the industry’s most active market segments in 2019 with 90 transactions each. The total transaction volume increased nine percent between 2018 and 2019, while the average deal size declined somewhat. The total value of M&A transactions in the education sector declined 21%t, from $15.64 billion to $12.30 billion.

Strategic Buyers

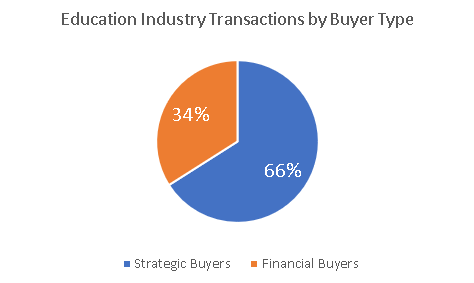

• Strategic acquisitions saw a nine percent gain on an annual basis, from 292 to 318 deals. Strategic buyers accounted for 66% of transaction volume and 52% of transaction value in 2019.

Financial Buyers

• Private equity sponsored transactions in the education sector increased eight percent over the past year, from 149 to 161 deals. Financial buyers represented 34% of the transaction volume and 48% of transaction value in 2019.

• The education industry’s largest acquisition in 2019 was Thoma Bravo’s purchase of Instructure for $1.86 billion. Instructure developed the very popular and widely used Canvas learning management system (LMS).

• The most active overall buyer in the Professional Training segment was Leeds Equity Partners with four acquisitions, including Kaplan Altior, which delivers classroom-based, online and in-house skills training and assessments to the legal and professional services sectors; VitalSmarts, a communication and leadership development training business; The Center for Legal Studies, which offers online programs and training courses for paralegals and other legal support professionals; and Watermark Learning, a business analytics and project management training company.

Valuation Multiples

Enterprise value multiples in the education sector have been strong over the past 24 months.

The industry’s median revenue multiple rose from 1.8x to 2.5x, while the median EBITDA multiple declined from 10.5x to 9.6x. However, these statistics can be misleading, since revenue and EBITDA multiples vary widely by sector and the size of the company being acquired. For example, EdTech companies that accounted for the largest volume of M&A transactions over the last 24 months sell for much higher multiples than higher ed institutions, childcare services, and professional training companies, as illustrated below.

Higher-Ed Institutions

Title IV post-secondary institutions with EBITDA of less than $3 million sold for an average EBITDA multiple of 4.0, while larger institutions with EBITDA over $3 million sold for an average EBITDA multiple of 5.0.

K-12 Institutions

K-12, early childhood, and tutoring and test-prep service companies with EBITDA less than $3 million sold for an average EBITDA multiple of 4.5, while similar companies with EBITDA over $3 million sold for an average EBITDA multiple of 5.5.

Professional Training Services

Professional training and continuing education companies with EBITDA less than $3 million sold for an average EBITDA multiple of 4.5, while similar companies with EBITDA over $3 million sold for an average EBITDA multiple of 5.5.

EdTech

Companies with revenue of less than $3 million sold for an average revenue multiple of 1.9 or an average EBITDA multiple of 6.8. While EdTech companies with revenue over $3 million sold for an average revenue multiple of 2.8 or an average EBITDA multiple of 9.5.

Transactions Per Segment

Higher-Ed Institutions

Transactions in the Post-secondary, Higher-Ed Institutions sector increased 46%, making it the sector with the largest year-over-year increase. The segment’s highest value transaction in 2019 was YDUQS’ announced acquisition of Adtalem Educacional do Brasil for $472 million. YDUQS is Brazil’s second-largest private higher education organization. Adtalem Educacional do Brasil offers programs in healthcare, law, business management, engineering, and technology and serves more than 81,000 degree-seeking students. However, the vast majority of higher-ed transactions involved small and mid-sized Title IV career or vocational schools that were acquired by larger Title IV schools, as the industry consolidation continues to playout.

Childcare Services

Deal flow in the Childcare Services sector remained relatively constant. Spire Capital portfolio company O2B Kids, which has eight locations in the Southeast US, was a very active buyer with the acquisitions of Brookside Academy, The Village Academy, and Home Away Frome Home.

EdTech/Media

Transaction volume in the K-12 Media and Tech segment stayed nearly the same on a yearly basis. High profile segment acquirers during the past year included ACT with the acquisition of Mawi Learning, which provides a suite of social-emotional learning (SEL) tools and services for school districts; Houghton Mifflin Harcourt with the acquisition of Waggle, a web-based adaptive learning platform that provides differentiated Math and ELA instruction for students in grades 2 through 8; Scholastic with the acquisition of Make Believe Ideas, a UK-based publisher of children’s books; and Weld North with the acquisitions of Glynlyon, a digital curriculum company; and Assessment Technology, Inc. (ATI), a provider of instructional improvement and effectiveness technology.

Deal activity in the Higher-Ed Media and Tech segment underwent a 15% increase from 2018 to 2019. Notable acquisitions include John Wiley & Sons’ acquisition of Zyante, a provider of computer science and STEM education courseware; and Elsevier’s acquisition of Parity Computing, which uses artificial intelligence to transform raw STM content for publishers and researchers.

Professional Training and Services

In the Professional Training segment, the number of Technology deals increased 21%, while Services transactions underwent a 4% increase. A few notable acquisitions in the combined Professional Training segments included Wendel Group’s acquisition of Crisis Prevention Institute, which provides behavior management and crisis prevention training programs, and 2U’s acquisition of Trilogy Education Services, which offers skills-based training programs in high-demand tech fields at universities and companies.

Conclusion

The transformation occurring in the education sector bodes well for continued strong M&A activity in 2020 and 2021. Many educational institutions have built or acquired important platforms for students, faculty, and administrators to improve educational outcomes. At the same time, increasing utilization of data, the need for efficient interoperability of existing systems, and acceptance of technology that drives student outcomes or employee performance are all enabling factors that have helped to keep M&A volume healthy.

Additionally, system infrastructure spending in both K-12 and post-secondary sectors has become more of a priority among states, school districts, and institutions. The product offerings available for these markets have become more compelling in terms of cost savings, learning impact measurability, and system compatibility. The potential revenue has also created a high stakes environment that has encouraged larger software developers to enter the market by acquiring smaller competitors.

About Jackim Woods & Co.

Jackim Woods & Co. is an independent M&A advisory firm that provides M&A advisory to education-related businesses, including K-12 schools, Title IV career colleges, test-prep and tutoring firms, and continuing education/professional training companies.

Jackim Woods & Co. is an independent M&A advisory firm that provides M&A advisory to education-related businesses, including K-12 schools, Title IV career colleges, test-prep and tutoring firms, and continuing education/professional training companies.

The firm offers skilled mergers and acquisitions services to privately held businesses and buyers, including private equity groups, in both sell-side and buy-side transactions. The principals at Jackim Woods & Co have been involved in over 100 business sales, with a combined value of over $450 million.

If you own an education-related company and are interested in exploring your options, please contact Rich Jackim, Managing Partner at 224-513-5142 or rjackim@jackimwoods.com.

Read More