Mid 2023 Recreational Vehicle Industry M&A Report

This article is a summary of recent M&A activity in the recreational vehicle industry in 2023.

The recreational vehicle industry is coming off two of the most profitable and demanding years in a row. The effects of the COVID-19 pandemic and economic shutdown greatly benefited all aspects of the industry, from manufacturers, dealers, repairs, and campgrounds. The companies that were ready capitalized greatly and added a new generation of customers to its base. But now what? 2023 is proving to be a very different year for all involved.

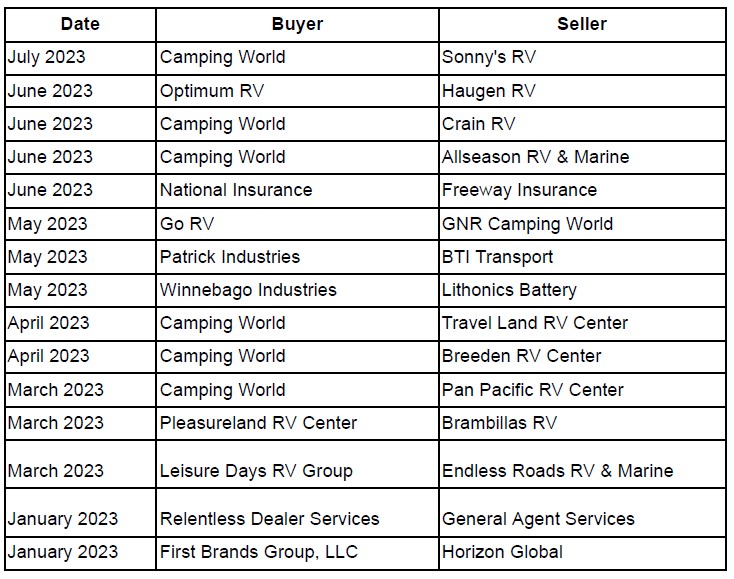

Recent Mergers and Acquisitions

Despite the recent slowdown in the RV industry as a whole, mergers, and acquisitions are still going strong. Marcus Lemonis, Chairman and CEO of Camping World, recently said, “Our goal is to achieve 50% growth in our store count over the next five years”. Camping World is currently the largest retailer of RVs and has 197 store locations. Many other conglomerates are looking to expand via acquisitions and new store openings.

By Craig Hudman, Managing Director at Jackim Woods & Co.

By Craig Hudman, Managing Director at Jackim Woods & Co.

Jackim Woods & Co. is a leading mergers and acquisition advisor focused on providing senior-level attention and flawless execution to clients in the recreational vehicle industry.

Craig is an experienced mergers & acquisitions professional, a former owner of a leading RV dealer, and a dealership management and operations expert. He brings over 30 years of RV-related experience.

To arrange a free, confidential initial consultation, please contact Craig Hudman at (208)521-1521 or chudman@jackimwoods.com.

Read More

Acquisitions in the Education and EdTech Sector in 2023

The following is a summary of mergers and acquisitions transactions in the education and edtech sectors in 2023. We try to update this post every week as we close more deals and learn of other deals that have closed in the sector.

The education and edtech sectors have seen a marked slowdown in activity so far in 2023. This is following a significant drop in valuations in 2022 as edtech companies no longer benefited from the COVID boost. That said, valuations for small, medium, and large edtech companies are back to their normal pre-COVID levels and are still significantly higher than valuations for traditional businesses, with the average small and medium-sized edtech companies being valued at approximately 3X trailing twelve-months revenue.

Acquisitions in the education and edtech sectors in 2023 so far

Below is a summary of the mergers and acquisition transactions in the education and edtech sectors so far in 2023. This list is updated every two weeks.

In December, Curriculum Associates, which sells research-based print and online instructional materials, assessments, and data management tools, acquired SoapBox Labs, an AI speech recognition company.

Carnegie, a New Heritage Capital backed company that provides innovative marketing and enrollment solutions in higher education, acquired Fire Engine Red, a student search service for college and university admissions offices.

ACI Learning acquired Infosec Learning, a company that provides colleges, universities, businesses, and governments with high-speed, intuitive virtual labs and cyber ranges for hands-on, personalized learning and skill assessment. The amount was undisclosed.

ParentSquare, which makes a tool to engage school families and communities, acquired Remind, which runs a secure communication platform for schools.

Allen Career Institute acquired Doubtnut, which makes a learning app that helps students solve math and science problems by taking photos of them, for $10 million. Doubtnut, which had raised over $52 million, was at one point valued at close to $150 million.

In November, Byju announced that it is in talks to sell Epic, its digital reading platform based in the U.S., for $400 million. The potential buyer was not disclosed.

Academic Partnerships has agreed to acquire Wiley’s online program management (OPM) division for approximately $110 million.

DaySmart, a business management company, acquired Sawyer, a business management company focused on the K-12 extracurricular activities market. The amount was not disclosed.

Flywire, a Boston-based software and payments company, acquired StudyLink, a student admissions company in Australia, for an undisclosed amount.

GMB Architecture and Engineering acquired Up and Up, a marketing firm focused on higher ed, for an undisclosed amount.

Enrollify, which offers professional development programs for higher ed marketing professionals, was acquired by Element451, a higher ed student engagement platform.

DaySmart, a business management software company, acquired Sawyer, which provides scheduling and payment solutions for K-12 extracurricular activities. The purchase price was not disclosed.

In October, Instructure, the edtech company that developed Canvas, a web-based learning management system, and MasteryConnect, an assessment management system, agreed to acquire Parchment, a digital credential company, for $835 million.

Rise In, a Web3 education platform, acquired the Web3 edtech company BlockBeam.

BibliU, a London, UK-based EdTech company, acquired Texas Book Company, a Texas-based industry leader in delivering learning materials to higher education institutions across the U.S.

Accelerate Learning, which produces STEM curriculum, acquired Kide Science, an online library of play and story-based lesson plans and professional development materials for kindergarten through 3rd grade teachers.

Discovery Education, a K-12 digital curriculum and learning services provider backed by Clearlake Capital, acquired DreamBox Learning, a provider of online software for math and reading education, for an undisclosed amount.

The Malvern School, a chain of early childhood education centers, was acquired by Busy Bees, an international early childcare provider that’s expanding in North America.

Ellucian, a leading provider of school management solutions, announced that it will acquire Tribal Group plc, a UK-based services and software provider.

In September, Meazure Learning, a test developer, acquired Examity, a leading online exam proctoring service, for an undisclosed amount.

A Chicago-based private equity firm, Golden Vision Capital Americas, acquired the educational software company Hawkes Learning for an undisclosed amount. Hawkes created the first adaptive learning educational software with embedded expert systems – the precursor to AI. Their comprehensive suite of innovative course materials encompasses a wide range of subjects, including Mathematics, English, Science, Statistics, Business, and Humanities.

Babbel, a language learning platform, acquired the browser extension Toucan to further expand its learning ecosystem with a browser extension. The amount was not disclosed.

FullBloom, a provider of special education instruction and interventions, acquired a counseling support company, EmpowerU, for an undisclosed amount.

QuantaSing, the Beijing-based learning and development provider, acquired Kelly’s Education, a Hong Kong-based online learning platform. The amount wasn’t disclosed.

In August, Presence, a K-12 teletherapy company, acquired RemoteHQ’s software platform for an undisclosed amount.

Clearlake Capital-backed Discovery Education, a K-12 digital curriculum and learning services provider, agreed to purchase Dreambox Learning, an edtech provider of online software for math and reading education.

SchoolStatus, a K-12 communications company, acquired the school engagement platform ClassTag. The amount wasn’t disclosed.

Noodle, a higher ed enrollment and infrastructure growth company, acquired Meteor, a higher ed-focused upskilling company, for an undisclosed amount.

Ascent, an outcomes-based leading and student success company, acquired the professional development platform Ampersand for an undisclosed amount.

Sallie Mae, the student lender, acquired “key assets” of Scholly, a scholarship search app, for an undisclosed amount.

Student data validation software provider Level Data acquired GlimpseK12, a curriculum measurement tool. The purchase price was not disclosed.

Kahoot, the publicly traded company that developed the popular online quiz tool was acquired by Goldman Sachs’ Private Equity for $1.2 billion in an all-cash deal.

In July, Edtech giant PowerSchool announced that it plans to acquire SchoolMessenger, which offers a range of voice, text, and online tools to help K-12 schools notify parents and students, for approximately $300 million.

Newsela, a K-12 content platform, acquired the instruction and assessment platform Formative for an undisclosed amount.

In June, Axcel Learning, an education acquisition business with financial backing from Alpine Investors, acquired ExitCertified, an online training company focused on upskilling and reskilling individuals, teams, and organizations.

In May, Learning technology company HMH acquired research and educational services organization NWEA. The combined organization will harness the collective power of instruction and research-based insights to support educators in their efforts to drive better outcomes for students.

Learneo, the company that owns CliffNotes, Course Hero, and Quillbot, acquired Barnes & Noble Digital Student Solutions for $20 million.

The learning management system, Go1 acquired the book summarizing subscription service Blinkist.

The University of Idaho announced last week that it intends to acquire the giant for-profit University of Phoenix, with 85,000 students, for $550 million.

Specialized Education Services, a K-12 services provider, acquired Illinois-based special education school NewHope Academy for an undisclosed amount.

Five Arrows, the alternative assets arm of Rothschild & Co., purchased n2y, a provider of comprehensive, technology-powered solutions for students with unique learning challenges, from The Riverside Company, a private investor.

In April, Raptor Technologies, a K-12 school safety software provider, acquired SchoolPass, a cloud-based solutions provider. The amount was not disclosed.

In March, Renaissance, a preK–12 education technology provider, acquired GL Education, a provider of formative assessments for schools.

Class Technologies Inc., a virtual software provider, acquired CoSo Cloud, a digital learning company, for an undisclosed amount.

Five Arrows, the alternative assets arm of Rothschild & Co, has acquired n2y, a provider of education technology solutions for students with learning challenges.

Docebo, a corporate training and learning platform with AI capabilities, has acquired PeerBoard, a knowledge-sharing platform.

Brightwheel, an all-in-one early education platform, has acquired Experience Early Learning, a research-based early education curriculum provider.

Excolere Equity Partners acquired a controlling interest in EPS School Specialty, a leading developer of curriculum products and services that enhance literacy and math skills for K-12th grade students, particularly those who are two-plus years behind grade level.

Parchment, based in the US, acquired the higher-ed platform Quottly for an undisclosed amount.

Voxy, based in Great Britain, acquired language-learning startup Fluentify for an undisclosed amount.

Carnegie, a leading provider of innovative marketing and enrollment solutions in higher education, has completed two acquisitions. In January of this year, Carnegie acquired the National Small College Enrollment Conference (NSCEC), the leading conference dedicated to serving the needs of small colleges. And secondly, in March, Carnegie acquired CLARUS Corporation, a leading provider of digital marketing solutions for community and technical colleges.

Teaching Channel, a provider of online teacher education, has merged with Learners Edge and Insight ADVANCE. The terms were not disclosed.

Highlights for Children, publisher of a magazine for kids and other media, acquired Tinkergarten, which provides play-based outdoor learning experiences to children six months to 8 years old.

UWorld, which provides learning tools to help students prepare for high-stakes tests, has acquired Wiley’s Efficient Learning test prep portfolio.

Vasil Jaiani, a data management company executive, has acquired two interactive educational websites, Visual Fractions and Worksheet Genius.

XL Learning, a provider of a learning resources platform for K-12 students, acquired Teachers Pay Teachers, a marketplace for teachers to sell lesson materials to each other.

Savvas Learning Company acquired Whooo’s Reading, a gamified reading platform driven by AI, for an undisclosed amount.

In March 2023, Lindenwood Education System, the non-profit parent entity of Lindenwood University, completed its acquisition of Dorsey College, a nationally accredited institution that provides career-focused education in the healthcare, skilled trades, culinary arts, emergency medical services, and beauty and wellness fields.

Atairos, an investment company, agreed to acquire LifeLabs Learning, an edtech platform that provides upskilling programs for managers.

Bain Capital Double Impact, LP acquired Meteor Education, LLC, from Saw Mill Capital Partners. Meteor is the leading provider for the design, delivery, and implementation of modern environments for K-12 schools, operating at the intersection of learning environments and learning experiences.

TPG’s Rise Fund picked up a controlling stake in the Malaysia-based Asia Pacific University of Technology and Innovation in a deal worth $300 million.

Perdoceo, which owns Colorado Technical University and American InterContinental University System, acquired the software engineering bootcamp Coding Dojo for $53 million.

Tutoring provider Paper acquired the college-readiness tool MajorClarity. The terms of the deal were not announced.

The Riverside Company, a global private investor focused on the smaller end of the middle market, has invested in Eduthings, a software solutions provider for Career and Technical Education (CTE) administrators, teachers, and students to track outcomes and monitor overall program effectiveness. Eduthings is an add-on investment to Riverside’s platform, iCEV, a leading developer of SaaS-based digital curriculum, instructional materials, and industry certifications for the CTE market.

Riverside Company acquired Human Element Solutions, LLC (Element H), a provider of live events, video, creative, and digital content solutions that optimize audience engagement within the pharmaceutical, biotech, and medical device/diagnostic industries.

U.S. News & World Report acquired CollegeAdvisor.com, a college admissions platform, from NCSA College Recruiting. The amount was not disclosed.

Study.com, an online learning platform, acquired the tutoring company Enhanced Prep for an undisclosed amount.

Accelerate Learning, a K-12 STEM curriculum provider was acquired by Providence Equity Partners. The terms were not disclosed.

Imagine Learning, one of the largest digital curriculum providers acquired Winsor Learning, whose staff will join Imagine Learning. The acquisition was announced as part of a new push into special education. The amount was not disclosed.

MSB School Services, a K-12 special education software provider, was acquired by Craftsman Capital, a private equity firm, for an undisclosed amount.

Thesis, a cloud-based administration software system for higher ed, was acquired by the private equity firm SilverTree. The amount wasn’t disclosed.

The student engagement platform Learning Explorer acquired Mosaic, the assessment system from ACT. The amount wasn’t disclosed.

ParentSquare, a K-12 engagement platform developer, acquired Gabbart Communications, a school communications tool. The amount wasn’t disclosed.

Online program management company Noodle acquired the South African-based Hubble Studios, a digital content developer, for an undisclosed amount.

Edustaff, a K-12 staffing company, announced it received a non-controlling investment from the private equity firm Public Pension Capital.

We will update this post every two weeks as we close more deals in the education and edtech sectors and learn about other transactions.

Read our previous article for information about mergers and acquisitions deals in the education and edtech sectors that closed in 2002.

About the Author and Jackim Woods & Co.

Rich Jackim is an education industry investment banker, educational industry entrepreneur, and former mergers and acquisitions attorney.

Rich Jackim is an education industry investment banker, educational industry entrepreneur, and former mergers and acquisitions attorney.

For the last 25 years, Rich has been providing boutique investment banking services to middle-market companies in the education sector.

Rich also founded a successful training and certification company called the Exit Planning Institute, which he sold to a private equity group in 2012.

Rich is also the author of the critically acclaimed book, The $10 Trillion Dollar Opportunity: Designing Successful Exit Strategies for Middle Market Businesses.

Jackim Woods & Co offers skilled mergers and acquisitions advisory services to privately owned schools, colleges, and EdTech companies in both sell-side and buy-side transactions. Jackim Woods & Co has arranged over 100 successful transactions, ranging from less than one million to more than eighty million dollars in value.

If you own an education-related business and are interested in exploring your options, I would welcome an opportunity to speak with you. Feel free to contact me at 224-513-5142 or rjackim@jackimwoods.com.

Read More

Kahoot Goes Private for $1.7 Billion in All Cash Deal

The popular education game developer Kahoot has gone private in a $1.7 billion all-cash deal.

At that valuation, the buyers of Kahoot, an Oslo-based developer that built and runs the popular quiz tool, paid a significant premium. But it’s still below the company’s COVID-era valuation, which valued the company at closer to $6 billion.

The Kahoot buyer group was led by Goldman Sachs’ private equity arm, with General Atlantic, KIRKBI Invest A/S (of LEGO Group), and Glitrafjord named as major investors.

Kahoot was listed on the Oslo Stock Exchange and went public in 2021. That same year, Kahoot acquired Clever, a platform developer that streamlined the edtech experience for schools, and according to their websites, says it serves half of all K-12 students in the U.S.

The premium price paid for Kahoot is an exception to the rule these days, as edtech companies find themselves in a more conversation valuation climate than the valuations paid during the pandemic. The visions many investors had of unlimited edtech growth, which fueled crazy valuations like Byju’s, have fallen apart, says Rich Jackim of Jackim Woods & Company, and valuations have returned to the more normal valuations seen for other SaaS companies.

In Jackim’s estimation, the new owners are likely to draw Kahoot and Clever farther from their roots, which raises questions about what the future direction of the company will be and whether Kahoot will continue to offer the Clever platform to schools for free for much longer.

In Jackim’s estimation, the new owners are likely to draw Kahoot and Clever farther from their roots, which raises questions about what the future direction of the company will be and whether Kahoot will continue to offer the Clever platform to schools for free for much longer.

If you own an education, training or edtech company and would like to explore your options, please contact Rich Jackim at rjackim@jackimwoods.com or 224-513-5142.

Read More

Mid 2023 Recreational Vehicle Industry Report

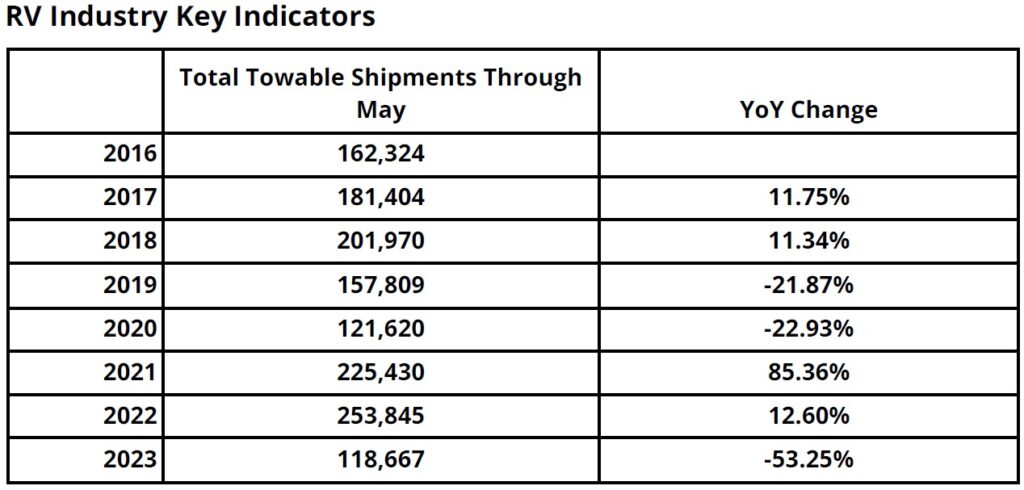

The recreational vehicle industry is coming off two of the most profitable and demanding years in a row. The effects of the COVID-19 pandemic and economic shutdown greatly benefited all aspects of the industry, from manufacturers, dealers, repairs, and campgrounds. The companies that were ready capitalized greatly and added a new generation of customers to their base. But now what? 2023 is proving to be a very different year for all involved.

The RV Industry as a whole is seeing the effects of record sales in the past two years. Sales have plummeted in part to the rising costs of RV and interest rate hikes. RV shipments in 2023 are at their lowest point since 2007-2008. Many dealers are still struggling to move new 2022 model year units while manufacturers slowly roll out 2024 model years. Projections put shipments in 2023 around 300,000 and 2024 in the mid 300’s. This added on top of interest rates that have nearly doubled over the last twelve months, and a poor national economic outlook has put most would-be buyers on hold. Interest rates are not expected to decrease until the latter part of 2024.

The RV Industry as a whole had an overall economic impact of $140 billion in 2022. More Americans are discovering the joys of camping. The average use of an RV is around 20 days per year. Manufacturers, Dealers and Campgrounds are staying busy with the huge influx of new buyers coming to the RV market as a result of the COVID-19 pandemic. These new customers are keeping both campgrounds and dealerships busy, not to mention the added strain on manufacturers and suppliers.

Thor, Forest River, and Winnebago account for 90% of all RV’s manufactured in the U.S. and Canada. These three “big” manufacturers continue to dominate and account for all brands commonly sold on most dealers’ lots. Towables account for close to 90% of the market, and the other 10% is motorized. Thor leads the way in towables and motorized market share, and Forest River is number two. The largest segment growth comes in the motorized class B with growth of around 8% per year. Winnebago currently claims 39% of this market. Texas continues to be the number one destination for wholesale RV shipments at nearly 10%, followed by California (6.4%), Florida (6.1%), Ohio (3.6%), and Michigan (3.5%). The median age for RV buyers has dropped to 33 years old. The amount financed on an RV has risen to around $45,000.

By Craig Hudman, Managing Director at Jackim Woods & Co., a leading mergers and acquisition advisor focused on providing senior-level attention and flawless execution to clients in the recreational vehicle industry.

By Craig Hudman, Managing Director at Jackim Woods & Co., a leading mergers and acquisition advisor focused on providing senior-level attention and flawless execution to clients in the recreational vehicle industry.

Craig is an experienced mergers & acquisitions professional, a former owner of a leading RV dealer, and a dealership management and operations expert. He brings over 30 years of RV-related experience.

To arrange a free, confidential initial consultation, please contact Craig Hudman at (208)521-1521 or chudman@jackimwoods.com.

Read More

You Don’t Know What You Don’t Know: Selling an RV Dealer

If you’ve ever heard the saying, “You don’t know, what you don’t know,” and never understood it, I was there also. I sold my family business about 18 months ago to a much larger company. At the time, I thought that knew a lot about the RV industry, after all, I was a third-generation owner. I figured if my grandfather and father had been successful for over 50 years, what they’d taught me ought to be enough. That idea, that concept embedded into the depths of my thought, couldn’t have been more wrong. I soon would learn “what I didn’t know.”

The first six months were really a blur. Our projections and goals were constantly changing based on more growth than I ever could’ve imagined. All of the new tools and information I now had at my disposal were amazing. Any question I had could be answered, and hunches could now be backed up with quantifiable data. I’ll admit it was a bit of an overload at first, but now it has become normal.

To people that have been brought into the light after having been in the dark, the world seems amazing, and this is how I felt. Along with this amazing feeling also comes a bit of shame. I now can say, “I didn’t know what I now know.” Shame comes from knowing that in 50 years of business, we never truly grew. Not when I came home from college with all my “fancy” degrees and learning. Not from an evolving economy. We only focused on small, consistent growth that was very risk-averse and preservation-minded. Debt was always considered bad. Sure, we made a great living, but now I know what could’ve been.

So to all those out there who “don’t know what you don’t know,” I suggest you learn before it cost you as much as it cost me. Sure, it cost me in the valuation of my company, but most of all, it cost me years of personal and professional growth. Now I am always searching for ways to improve, so if I am ever in the same position, my “don’t know” won’t last very long.

So to all those out there who “don’t know what you don’t know,” I suggest you learn before it cost you as much as it cost me. Sure, it cost me in the valuation of my company, but most of all, it cost me years of personal and professional growth. Now I am always searching for ways to improve, so if I am ever in the same position, my “don’t know” won’t last very long.

If you own an RV dealer, supplier, or OEM and would like to explore your growth options or exit options, I would welcome an opportunity to speak with you. Feel free to contact me for a confidential, no-cost, no-obligation consultation at chudman@jackimwoods.com or 208-521-1521. I look forward to speaking with you.

Read More