Mid 2023 Recreational Vehicle Industry Report

The recreational vehicle industry is coming off two of the most profitable and demanding years in a row. The effects of the COVID-19 pandemic and economic shutdown greatly benefited all aspects of the industry, from manufacturers, dealers, repairs, and campgrounds. The companies that were ready capitalized greatly and added a new generation of customers to their base. But now what? 2023 is proving to be a very different year for all involved.

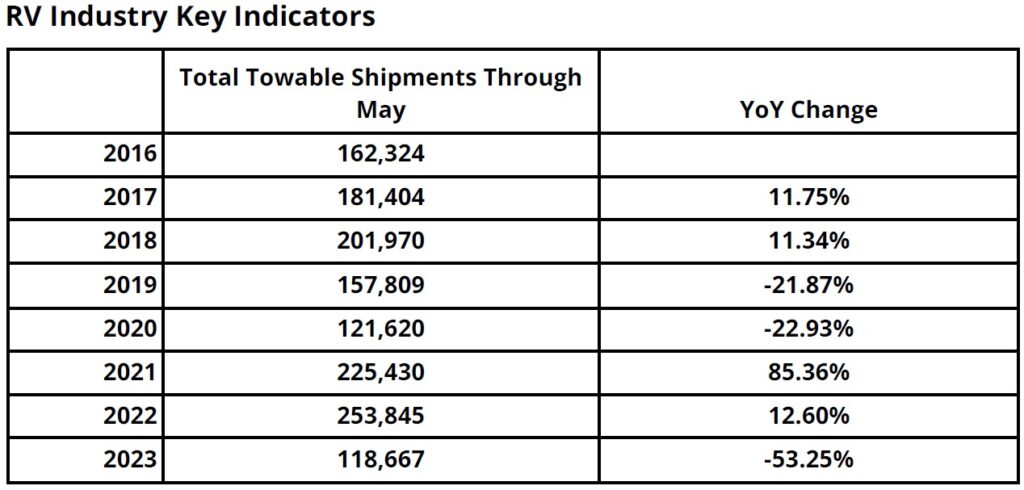

The RV Industry as a whole is seeing the effects of record sales in the past two years. Sales have plummeted in part to the rising costs of RV and interest rate hikes. RV shipments in 2023 are at their lowest point since 2007-2008. Many dealers are still struggling to move new 2022 model year units while manufacturers slowly roll out 2024 model years. Projections put shipments in 2023 around 300,000 and 2024 in the mid 300’s. This added on top of interest rates that have nearly doubled over the last twelve months, and a poor national economic outlook has put most would-be buyers on hold. Interest rates are not expected to decrease until the latter part of 2024.

The RV Industry as a whole had an overall economic impact of $140 billion in 2022. More Americans are discovering the joys of camping. The average use of an RV is around 20 days per year. Manufacturers, Dealers and Campgrounds are staying busy with the huge influx of new buyers coming to the RV market as a result of the COVID-19 pandemic. These new customers are keeping both campgrounds and dealerships busy, not to mention the added strain on manufacturers and suppliers.

Thor, Forest River, and Winnebago account for 90% of all RV’s manufactured in the U.S. and Canada. These three “big” manufacturers continue to dominate and account for all brands commonly sold on most dealers’ lots. Towables account for close to 90% of the market, and the other 10% is motorized. Thor leads the way in towables and motorized market share, and Forest River is number two. The largest segment growth comes in the motorized class B with growth of around 8% per year. Winnebago currently claims 39% of this market. Texas continues to be the number one destination for wholesale RV shipments at nearly 10%, followed by California (6.4%), Florida (6.1%), Ohio (3.6%), and Michigan (3.5%). The median age for RV buyers has dropped to 33 years old. The amount financed on an RV has risen to around $45,000.

By Craig Hudman, Managing Director at Jackim Woods & Co., a leading mergers and acquisition advisor focused on providing senior-level attention and flawless execution to clients in the recreational vehicle industry.

By Craig Hudman, Managing Director at Jackim Woods & Co., a leading mergers and acquisition advisor focused on providing senior-level attention and flawless execution to clients in the recreational vehicle industry.

Craig is an experienced mergers & acquisitions professional, a former owner of a leading RV dealer, and a dealership management and operations expert. He brings over 30 years of RV-related experience.

To arrange a free, confidential initial consultation, please contact Craig Hudman at (208)521-1521 or chudman@jackimwoods.com.