Mid 2023 Recreational Vehicle Industry M&A Report

This article is a summary of recent M&A activity in the recreational vehicle industry in 2023.

The recreational vehicle industry is coming off two of the most profitable and demanding years in a row. The effects of the COVID-19 pandemic and economic shutdown greatly benefited all aspects of the industry, from manufacturers, dealers, repairs, and campgrounds. The companies that were ready capitalized greatly and added a new generation of customers to its base. But now what? 2023 is proving to be a very different year for all involved.

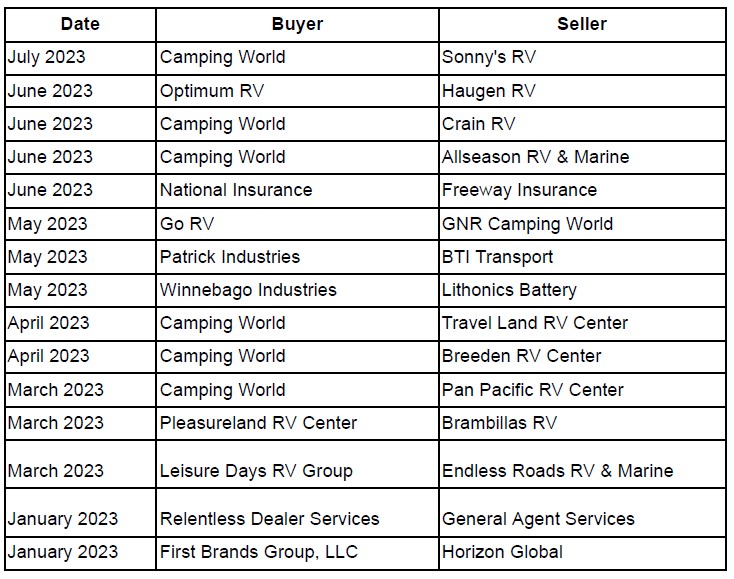

Recent Mergers and Acquisitions

Despite the recent slowdown in the RV industry as a whole, mergers, and acquisitions are still going strong. Marcus Lemonis, Chairman and CEO of Camping World, recently said, “Our goal is to achieve 50% growth in our store count over the next five years”. Camping World is currently the largest retailer of RVs and has 197 store locations. Many other conglomerates are looking to expand via acquisitions and new store openings.

By Craig Hudman, Managing Director at Jackim Woods & Co.

By Craig Hudman, Managing Director at Jackim Woods & Co.

Jackim Woods & Co. is a leading mergers and acquisition advisor focused on providing senior-level attention and flawless execution to clients in the recreational vehicle industry.

Craig is an experienced mergers & acquisitions professional, a former owner of a leading RV dealer, and a dealership management and operations expert. He brings over 30 years of RV-related experience.

To arrange a free, confidential initial consultation, please contact Craig Hudman at (208)521-1521 or chudman@jackimwoods.com.

Read More

Private Equity Firms Continue to Consolidate RV Industy

Over the past 20 years or so, some of the biggest names in the RV industry – Heartland, the REV Group, Fleetwood, Monaco, Dometic, Roadtrek, Grand Design, Lazydays RV Center and Camping World, to name a few – have been acquired by private equity groups (PEGs) like Bain Capital, Alliance Holdings, American Industrial Partners, Catterton Partners, Kidd & Co., and Main Street Capital.

For the most part, these PE firms operate quietly and without a lot of press, but they can have had a profound impact upon an industry, buying a mid-size RV company as a “platform investment” and then growing that company organically and through a series of smaller add-on acquisitions. The PEG’s goal is to triple or quadruple the size of the platform investment over the next 5-6 years. This buy and build strategy often converts their portfolio companies into industry leaders and creates or saves thousands of jobs in the process.

Determining the magnitude of private equity investment in the RV industry is challenging because private equity deals are private and the terms are typically not reported. Also, unlike publicly traded companies, private equity groups are not required to share their financial statements. In fact, in many cases, PE groups prefer to operate behind the scenes and not to promote their ownership of RV companies.

Nonetheless, Jackim Woods & Co., a mergers and acquisitions firm that specializes in the RV sector, has developed a proprietary database of strategic buyers and private equity groups interested in the RV sector and has tracked more than 65 transactions involving private equity firms over the last 20 years.

It is interesting to note that private equity interest spans the breadth of the RV sector and includes RV manufacturers, RV suppliers, RV distributors and RV dealerships.

While private equity firms have been involved in the RV market for more than two decades, interest in the RV industry has picked up since 2012.

“I believe that the RV industry continues to be very fertile ground for private equity investment,” says Rich Jackim, founder and managing partner at Jackim Woods & Co.

Jackim, an investment banker who focuses on the RV industry and has worked as a mergers and acquisitions consultant since 1993, says the current market is “probably one of the strongest seller’s markets we’ve seen in the last 15 years. Private equity groups have around $250 billion in dry powder that they need to invest, so the larger your RV company, the more interest you’ll get from private equity firms.”

According to Jackim, private equity firms “have a lot of money in their pockets right now but relatively few good quality opportunities to look at so we are very fortunate to be able to present our clients with multiple offers from buyers.”

According to Jackim, private equity firms “have a lot of money in their pockets right now but relatively few good quality opportunities to look at so we are very fortunate to be able to present our clients with multiple offers from buyers.”

If you are interested in understanding what your RV business might be worth or exploring your options, please contact Rich Jackim at (224) 513-5142 or at rjackim@jackimwoods.com.

Read More